A Loan Agreement is a binding contract between a lender and a borrower, detailing the terms of the loan such as the amount, repayment schedule, interest, and any security on the loan.

The document serves to protect both parties. It provides the lender with legal recourse for non-repayment and clarifies terms for the borrower, thereby preventing disputes.

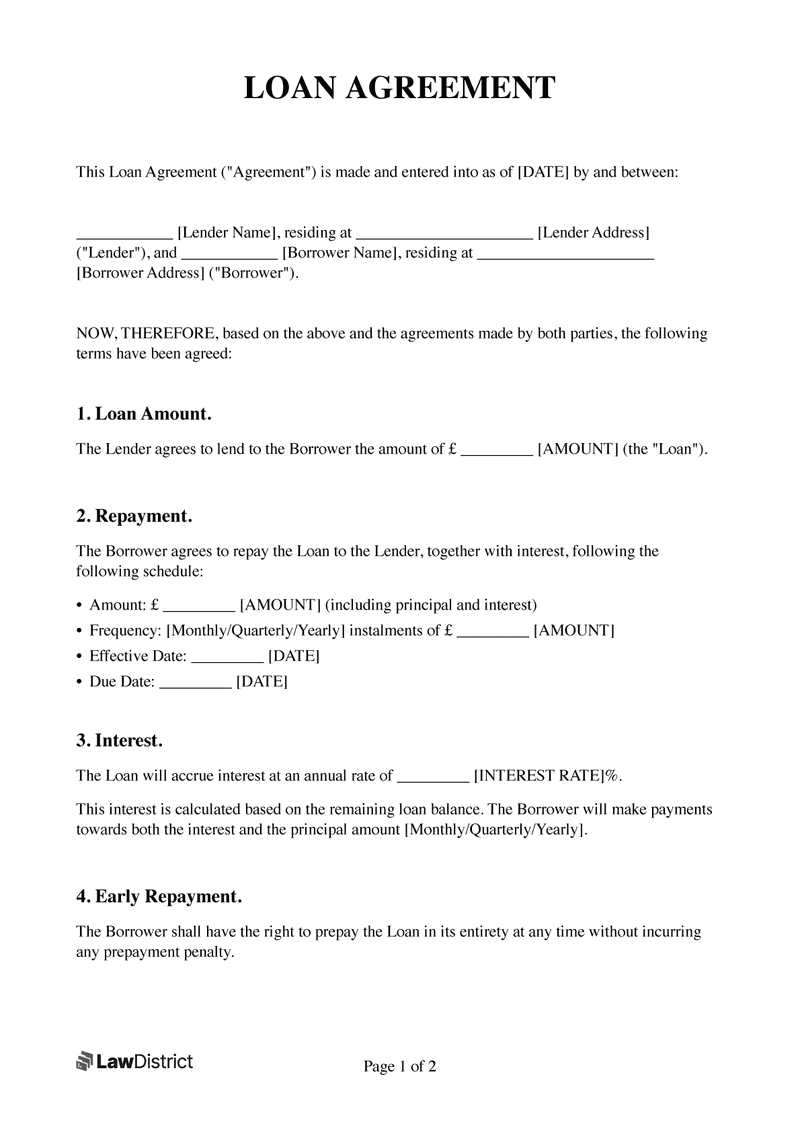

These agreements range from simple formats for personal loans among acquaintances to detailed documents for substantial transactions like business loans or mortgages, which may require legal guidance to ensure compliance with UK laws.

Simple agreements are straightforward, focusing on essential terms, while more complex ones include provisions on defaults and collateral.

When should you use a Loan Agreement?

A Loan Agreement becomes necessary to establish the terms under which financial assistance is given, ensuring both parties understand their obligations and rights. Such agreements are particularly crucial when:

- Family and friends: Clarifies financial exchanges as loans or gifts. Set clear repayment terms and prevent disputes.

- Property purchases: Requires the lender's interest to be secured against the property, including notifying mortgage lenders due to potential implications on mortgage terms.

- Compliance and taxation: Determines if the loan is a regulated mortgage contract, especially if the loan is secured against a property and involves family members.

Employing a Loan Agreement under these scenarios helps maintain clear terms between parties, ensuring legal protection and mitigating potential conflicts.